Genius Customer Engagement Platform

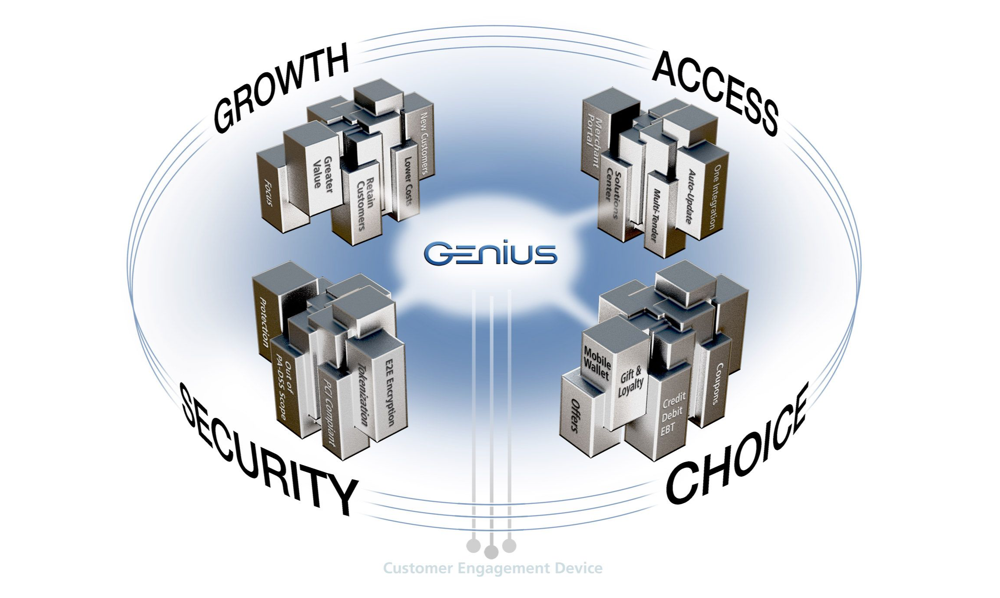

The Genius Customer Engagement Platform is a breakthrough, industry-first solution that has the ability to serve as a single payments hub for retailers, addressing the challenge of how to support traditional credit and debit payments and future mobile commerce on the retail countertop from a single platform.

Retailers deserve to benefit from a simple, flexible, secure integrated payment solution for their retail management software. The Genius™ Customer Engagement Platform™ delivers exactly that, with the ability to accept any payment type or mobile wallet, and expands engagement opportunities with existing and new customers through gift, loyalty, rewards and offers. With Genius, retailers are empowered with incremental growth opportunities today and positioned well for the future with a mobile commerce-ready solution.

Retailers are currently struggling with rapidly evolving consumer payment technologies – from the mandated EMV (Europay/Mastercard Visa)contactless “Chip and pin” cards, to the number of mobile payment applications available, to reinforcing security to protecting consumer data. In addition, new types of reward, loyalty, gift and integrated mobile marketing solutions are also emerging daily. It is more important than ever for retailers to have the ability to manage this change.

Today’s retailers need to be able to accept any payment type presented by the consumer, and should be able to do so simply and transparently. An integrated solution for point-of-sale and payment processing will save you time and money and provide you with enhanced security to protect your customer data.

BENEFITS OF THE GENIUS PLATFORM

SIMPLIFIED COMPLIANCE

Integrated processing with a PA-DSS validated POS system will alleviate many of the burdens PCI compliance creates for your business: Reduces the time and effort required to perform your PCI compliance audit. With traditional card acceptance, sensitive information passes through the POS. This requires a more expensive and detailed PCI audit – putting you at greater risk for compliance.